Head Office

DSE Tower, L8-148,

Plot 46, Road 21, Nikunja 2,

Dhaka 1229, Bangladesh

Uniroyal Securities Limited (USL) is a full service brokerage firm having Trec No. 089 with Dhaka Stock Exchange Plc and DP # 21 with Central Depository Bangladesh Limited.

USL started its journey back in 1990 under the name Asoke Das Gupta by its Founder Late Mr. Asoke Das Gupta, a valiant freedom fighter who served as sub-sector commander under H.Q. Sector 1.

He was the founder and sponsor of One Bank Plc.

To Provide an efficient, secure, and reliable platform for trading on the Dhaka Stock Exchange (DSE) while offering expert market insights and investment advisory to help clients make informed decisions.

To be a trusted and innovative stock brokerage firm, empowering investors to grow their wealth through transparency, high-quality service, and advanced technology.

Private Limited Company, registered with the Bangladesh Securities and Exchange Commission (BSEC) and a TREC of DSE.

USL believes the capital market should be accessible to everyone. Hence, we launched uTrade allowing you to trade at your own pace and on your own terms. USL has no investment minimums.

Mrs. Rakhi Das Gupta is serving as the Chairman since December 2020. She is Sponsor Director of Dhaka Bank Limited. She has served as Vice-Principal and English Teacher for Willes Little Flower School and taught English in various other schools throughout her lifetime. She has Masters of Arts in English Literature from University of Dhaka.

Mr. Anirban Das Gupta is serving as Managing Director since 2006. He serves as Consultant to a life insurance company, Protective Islami Life Insurance. He is an Angel Investor to IT Education institute, CodersTrust and runs an ITES firm, nexim as CEO & Proprietor. He has dual Masters of Science and Masters of Business Administration in eCommerce (IT Management) from Fox School of Business & Management, Temple University, Philadelphia, Pennsylvania, United States, and Bachelors of Business Administration in Economics from Texas Tech University, Lubbock, Texas, United States.

Mr. Swapan Kumar Kundu is serving as Company Secretary. He has been with us since its inception in 1990. He has Masters of Science in Statistics from Rajshahi University.

Managing Director – Mr. Anirban Das Gupta is serving as Managing Director since 2006. He has dual Masters of Science and Masters of Business Administration in eCommerce (IT Management) from Fox School of Business & Management, Temple University, Philadelphia, Pennsylvania, United States, and Bachelors of Business Administration in Economics from Texas Tech University, Lubbock, Texas, United States.

Chief Financial Officer – Mr. Prolad Chakrabarty is serving USL since 2010. He has Masters of Commerce in Accounting from Rajendra College, Faridpur

Chief Technology Officer – Mr. Sultan Mahmud is serving USL since 2015. He has Bachelors of Science in Computer Science & Engineering from Southeast University, Dhaka

Chief Depository Officer – Mr. Riaj Mahmud (Shawon) is serving USL since 2014. He has Masters of Business Administration in Finance & Banking from Dhaka International University

Company Secretary & Chief Compliance Officer – Mr. Swapan Kumar Kundu is serving USL since 1990. He has Masters of Science in Statistics from Rajshahi University.

Email:

info@utrade.com.bd

Call us for Services

(8802 4104 0025-26)

Investing 101 is all about understanding how to grow your wealth over time through various financial vehicles like stocks, bonds, real estate, and more. Here’s a breakdown of the key concepts and strategies:

Investing involves committing money or capital to an asset, with the expectation that it will grow in value over time. The goal is to earn a return on your investment—either through price appreciation (increasing value) or income generation (dividends, interest, etc.).

Stocks (Equities): Buying shares of a company, which gives you ownership in that company. Stocks can provide high returns but are also volatile.

Bonds:

Loans you give to governments or corporations in exchange for interest payments and the return of your principal at maturity. Bonds are generally considered lower risk than stocks but offer lower returns.

Real Estate:

Purchasing property to generate rental income or capital appreciation. Real estate can provide a tangible asset that often appreciates in value over time. Mutual Funds and ETFs (Exchange-Traded Funds): These are pooled investments that allow you to buy a diversified portfolio of stocks, bonds, or other assets. They offer exposure to a range of investments without requiring you to pick individual stocks or bonds.

Commodities:

Investments in physical goods like gold, oil, or agricultural products. Commodities can be more volatile but can hedge against inflation or economic instability.

Higher returns often come with higher risk. Stock prices can fluctuate wildly, but over the long term, they tend to grow in value.

Bonds and other fixed-income investments are generally safer but offer more modest returns.

Real estate can offer stability and appreciation but also carries risks like property value fluctuations and the hassle of managing property.

A key strategy in investing is diversification—spreading your investments across different asset classes to reduce risk. By owning a mix of stocks, bonds, and other assets, you’re less likely to lose all your money if one asset class performs poorly.

The time horizon is how long you plan to keep your money invested. Longer time horizons allow for greater risk-taking, as you have time to recover from market downturns.

Compounding refers to the process where the returns on your investments (interest, dividends, capital gains) are reinvested, and you earn returns on both your initial investment and your previous returns. The longer your money stays invested, the more you can benefit from compounding.

The earlier you start investing, the more time your investments have to grow. Even small contributions can grow significantly over time thanks to compounding.

Buy and Hold:This involves buying investments and holding them for the long term, regardless of short-term market fluctuations.

Taka-Cost Averaging (TCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It helps reduce the impact of volatility by buying more shares when prices are low and fewer when prices are high.

Value vs. Growth Investing:Value Investing: Buying undervalued stocks with the expectation that their price will increase.

Growth Investing: Focusing on companies that are expected to grow quickly, even if their stock price appears high relative to current earnings.

Everyone has a different level of comfort when it comes to risk. It's important to assess how much risk you're willing to take based on your financial goals, age, and personal comfort. Risk tolerance can be broken down into three main categories:

Conservative: Prioritizing safety and steady returns.

Moderate: Willing to accept some volatility for higher returns.

Aggressive: Comfortable with high risk for the potential of high returns.

Identify your investment goals—whether it's retirement, buying a home, or funding your child’s education. Different goals have different time horizons and risk tolerances.

The market will have ups and downs. It’s important to stay disciplined and stick to your investment plan, especially during market downturns. Emotional decision-making often leads to poor outcomes.

Continuously educate yourself and stay informed about the markets, investment strategies, and changes in tax laws. The more you know, the better you can make informed decisions

By starting small and educating yourself about different investment options, you can begin to build a portfolio that aligns with your financial goals and risk tolerance.

Content is provided for informational purposes only, does not constitute tax or investment advice, and is not a recommendation for any security or trading strategy. All investments involve risk, including the possible loss of capital. Past performance does not guarantee future results.

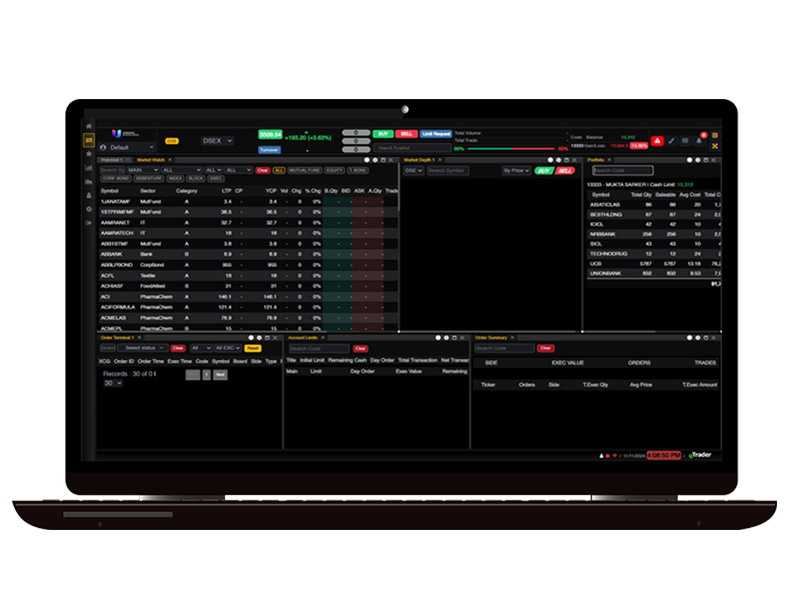

UTRADE is an online brokerage firm that offers trading services for stocks, bonds, mutual funds, and other securities. It provides tools and resources for investors to manage their portfolios, research investments, and execute trades.

To open an account, visit utrade.com.bd website and click on "Open BO Account." You’ll need to provide personal information, including your National Identification Number, employment details, and financial information. UTRADE offers various account types, such as individual brokerage accounts, joint accounts and corporate accounts.

UTRADE offers several types of accounts, including:

UTRADE has a range of fees depending on the service. For example:

UTRADE offers a variety of research tools, including:

Yes, UTRADE offers mobile apps for iOS and Android devices, which allow you to trade, track investments, research, and manage your account from anywhere.

You can fund your UTRADE account through several methods:

You can contact UTRADE customer support via:

If you forget your username or password, you can reset them through the UTRADE website or app. Simply follow the prompt under the "Forgot Password" link.

UTRADE uses industry-standard security protocols, such as encryption and multi-factor authentication, to protect your personal and financial information.

Yes, UTRADE offers margin loans, which allow you to borrow funds from your brokerage account to buy securities. The amount you can borrow depends on the value of your assets and your margin requirements. Keep in mind that margin trading involves risk and you may be required to repay the loan if the value of your investments’ declines. We can assist you in opening Margin Account with our Panel Merchant Banks if your loan requirement is substantial.

Yes, UTRADE allows you to set up recurring deposits into your account. You can set up automatic contributions for your brokerage accounts.

To place a trade, log into your UTRADE account, go to the trading section, and select the type of asset (stock, bond, mutual fund, etc.) you want to trade. Enter the ticker symbol, choose the order type (market, limit, stop), and enter the amount of shares/contracts you want to buy or sell. After reviewing the details, confirm the trade.

UTRADE POWER is a sophisticated, web-based trading platform designed for ACTIVE TRADERS. It offers advanced tools, including:

Yes, UTRADE offers a variety of educational resources, including:

UTRADE offers several types of orders to help you manage your trades:

UTRADE offers tools to help you track and analyze your portfolio's performance. You can:

Yes, UTRADE provides tax-related tools and reports to help you manage your investments. You can download:

UTRADE uses a combination of security measures to protect your account, including:

UTRADE does not offer banking service.

To close your UTRADE account, contact customer service. You may be asked to transfer any remaining assets to another brokerage or bank account. Ensure that any outstanding trades or fees are cleared before the account is closed. Account Closing Fee is BDT 200/=

If you encounter issues with your UTRADE account, you can reach out to customer service. They offer support through phone, email, or live chat. The website also features an extensive knowledge base to help you troubleshoot common problems.

DSE Tower, L8-148,

Plot 46, Road 21, Nikunja 2,

Dhaka 1229, Bangladesh

(8802) 4104-0025

(8802) 4104-0026

info@utrade.com.bd